SECRETS TO A TAX-FREE RETIREMENT

IT'S TIME TO PROTECT YOURSELF

FROM THE DANGERS OF INCREASING TAXES AND MARKET VOLATILITY WITH A MAX-FUNDED TAX-ADVANTAGED INSURANCE CONTRACT

(...without putting any of your hard earned money at risk in the market!)

FROM: The Desk of Dora Wysocki

Dear Friend,

If you're planning on retiring in the near future (or are already in retirement), what you're about to read has the potential to make your golden years the most comfortable and secure years you have ever experienced.

You've most likely done well financially in the past—you've been smart about your money, worked hard, and probably enjoyed great returns on your efforts during the 90s. But you may have been a victim of the harsh volatility of plummeting stock market and real estate values that followed.

Have you noticed that things aren't the way they used to be? Those days of decade-long booming stock market growth are dead. Remember 2000 to 2010? I call that the LOST DECADE for a reason. For those who had worked hard and saved even harder, it was a crushing blow when retirement and home values hit the bottom with a heavy thud!

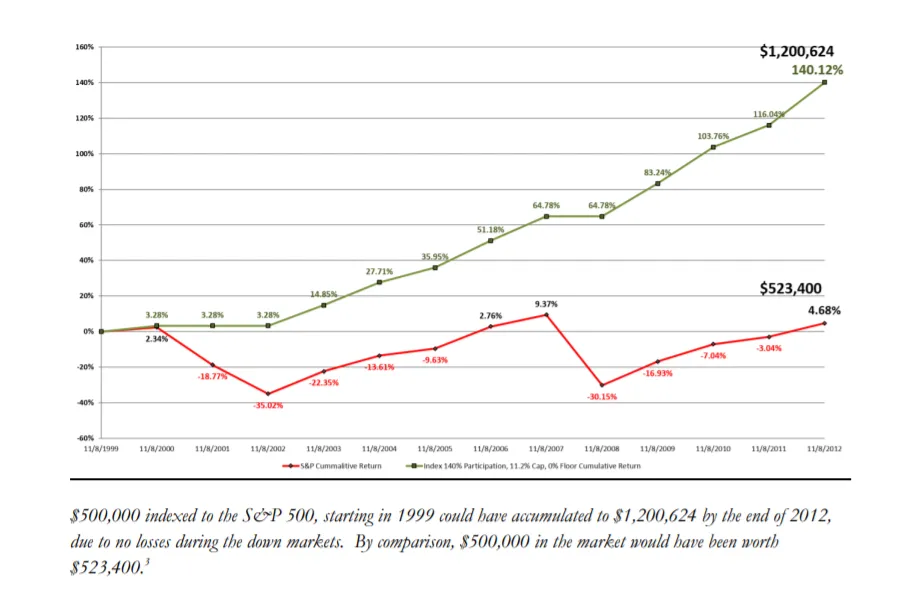

Most Americans lost 38% in the value of their IRAs and 401(k)s from 2000– 2003. It took four more years (until 2007) just to recoup what they lost.

To illustrate a common experience, let’s say a couple was planning on retiring in the year 2000 and they had a nest egg of $1 million. They saw that nest egg erode away to $600,000 by 2003; and it took until the end of 2007 for it to return to $1 million. Hoping to be able to retire on about $6,000 a month from their $1 million nest egg (assuming a rate of return of 7.2%), their dreams were shattered when in one single year—2008—they witnessed that $1 million nest egg lose 40%. Not only that, but their real estate values also plummeted.

“Enough already” is what they said, and like many Americans they transferred their money out of the market and put it in banks earning them 1% or less. Do the math. Now these retiring people are earning 1% on $600,000, which is $6,000 per

year, when just 12 months earlier they were hoping to have retired on $6,000 per month. They are down to one-tenth of their expected income. As a result they, along with many Americans, felt like they lost their future.

AMERICANS DON’T HAVE TO LOSE SO MUCH

The fact of the matter is, no one following the strategies I will outline in this letter lost money due to market volatility—not after 9/11 and not even in 2008. During that time many clients not only doubled their money tax-free during the lost decade, but by year-end 2012, many people following our strategies actually tripled their money tax free from 2000 to 2012. Keep reading to see how.

Over the last few years, the economy has been a bit better, but the upturn isn't here to stay. The stability and predictable growth of real estate and stock market portfolios are a thing of the past. The global economy, terrorism, massive national debt, national healthcare, and higher taxes have created a entirely new financial landscape.

I'm warning you. Those "incredible days" of consistent and reliable stock market growth are gone! Additionally, the periods of year after-year predictable real estate appreciation are gone, as well.

THE "BUY AND HOLD" IS NO LONGER WISE ADVICE. The notion that the market always goes up is no longer true. Traditional IRAs and 401(k)s are not the best way to save for retirement. In fact, they are no longer even a good way to go. People are typically not in lower tax brackets when they retire—that has not been axiomatic for the last 25 years. Yet most people continue to put money into tax deferred accounts, following traditional advice—doing the same thing over and over again, expecting different results (isn’t that the definition of insanity?). They will end up outliving their money due to the negative impact of taxes, inflation and continued market volatility.

It doesn't have to be this way any longer if you take action right now.

Postponing your financial education is like ignoring a big rock in your shoe ... you can still walk but it's going to be painful. If you're like me, I avoid pain at all expense, and FOR THOSE WHO AREN'T DECISIVE AND SAVVY, MORE SEVERE FINANCIAL PAIN IS AROUND THE CORNER.

The harsh reality is that you may not be as prepared as you think, even though you have a sizable "nest egg." If you're relying on your traditional IRA/401(k) to supplement your Social Security benefits and maybe even pension, be prepared to have taxes erode away your cash.

Over the last 12 months I've taught educational series and webinars for thousands of individuals, families, and businesses. Not once has anyone ever disagreed that future taxes WILL BE HIGHER than they are now.

With taxes on the rise, I look for every valid and legal way to maximize my income and minimize my taxes. I'd rather redirect my money for vacations, grandchildren, and causes that I support, than give that cash to the government in unnecessary taxes. I'm sure you're the same.

MONEY FOR UNCLE SAM … OR YOU?

You may not realize that when you reach retirement, you may lose many of the deductions you once enjoyed, such as home mortgage interest, dependents, and retirement plan contributions. And if you're a business owner, you'll be losing even more deductions. Although you may have less income during retirement, your taxable income may be just as high or higher!

If you don't take action to avoid paying excess tax, you'll likely be in for a rather unwelcomed surprise during your retirement years, which could result in living a lower lifestyle, or outliving your money.

No matter how you look at it, paying less in taxes means keeping more for yourself. In our opinion, as part of your tax-reducing retirement strategy, you should take a serious look at MAX-FUNDED, TAX-ADVANTAGED (MFTA) INSURANCE CONTRACTS.1

When structured properly and funded correctly a MFTA Insurance Contract will knock the socks off any typical IRA or 401(k).

PROTECT YOURSELF FROM INCREASING TAXES

Along with their important death benefit, these contracts can be structured to hold your serious cash (by serious cash we mean money you have set aside for retirement). When structured correctly and funded properly, these contracts shelter you from the danger of increasing taxes.

Here is how a properly structured contract can shelter you from increased taxation:

Tax Savings #1 - Money put into these insurance contracts has already been taxed at today's rates, not tomorrow's. With tax rates likely going up in the future (to unknown amounts!), getting taxes over and done can be financially critical. Keep in mind, you’d always rather pay taxes on the seed money than the harvest money.

Tax Savings #2 - Money taken out of your contract—when done optimally, in accordance with Internal Revenue Code guidelines---is not regarded as taxable income, as opposed to income from a traditional IRA/401(k). You can also access your money tax-free using several methods. The smartest and best way to access your money from a max-funded, tax-advantaged insurance contract is via a loan, rather than a withdrawal.

Here’s why:

When done correctly, it is a loan made to yourself that is never due or payable in your lifetime. To be in compliance with IRS guidelines, an interest rate is typically charged, and then that interest is offset with interest that is credited on the money you didn’t “withdraw,” but rather remained there as collateral for your loan. This results in a zero net cost in many instances (2).

Loans taken from your contract ARE NOT TAXED, because they aren't deemed earned, passive, or portfolio income—which are the only types of income that are subject to income tax on a 1040 tax return. See section 7702 of the Internal Revenue Code

"A maximum-funded tax-advantaged insurance strategy, when

structured properly and loans taken correctly, will not hit your tax

return. That is powerful."

-Jim Whitehead, CPA

www.jimwhiteheadcpa.com

Jim Whitehead, CPA

www.jimwhiteheadcpa.com

Tax Savings #3 - With industry laws and regulations that have been in place for more than 100 years, the money that accumulates inside of a life insurance policy does so tax-favored. As a "life insurance policy" increases in value due to competitive interest being earned, no taxes are due on that gain, as long as the policy remains in force. Many financial vehicles, such as savings accounts, CDs, mutual funds, and money markets will typically have tax liability on their gain. See section 72(e) of the Internal Revenue Code.

Tax Savings #4 - Upon your death, the money in your insurance policy transfers to

your heirs and beneficiaries completely income tax-free. See section 101(a) of the Internal Revenue Code.

In summary, I have never seen any other money accumulation vehicle that accumulates money totally tax-favored, then later allows you to access your money totally tax-free. Then when you ultimately pass away, it blossoms (increases) in value and transfers to your heirs totally income-tax free.

As a side note, I don't recommend that every retirement dollar you set aside be in a max-funded, tax-advantaged insurance policy. While you will learn more during one of our seminars or personal consultations, just know that significant amounts of taxes can be reduced by including this type of insurance contract in your retirement portfolio—or by making it your primary retirement strategy like thousands of other highly successful, wealthy people have done.

"Many years ago, early in my career, I remember going to a tax seminar done by a national CPA firm. I asked the instructor about accumulation of wealth using maximum-funded, tax-advantaged insurance contracts and he said, 'This is one of the most powerful things that I've ever seen.' I was a younger CPA then and was impressed with his response. I've worked with Doug over the years and am impressed with his concepts and who he is. The accumulation of wealth inside a MFTA insurance contract is very, very powerful."

-Marvin Paul Neumann, CPA

As a hypothetical illustration, let's say that you want $100,000 per year during retirement for travel, fun, and expenses, and you're in a 33% tax bracket (between all of the taxes you pay).

The 401(k) Way: In order to net $100,000, you'll need to pull $150,000 out of your 401(k). In other words, you’ll be sending $50,000 (or one-third of your money) in taxes to Uncle Sam!

The MFTA Way: In a properly structured max-funded, tax-advantaged insurance contract, a loan of $100,000 equals $100,000. Zero dollars go to taxes! How much longer will your hard-earned money last if you don't have to pay tax on that money? How much more peace of mind will you have if you don't have to worry about your money running out due to increasing taxes eating away at your distributions? Based on the same net spendable income, empowering yourself with this strategy can be the difference between depleting your retirement nest egg in seven to 11 years, versus never outliving your money—no matter how long you may live.

Is this a tax loophole?

No, these are not tax loopholes. Max-funded, tax-advantaged insurance contracts have been used by the wealthy, both personally and in business, to protect and perpetuate wealth for decades. The IRS has fully defined these benefits within Internal Revenue Code sections 7702, 72(e), and 101(a).

To be clear, the tax advantages of max-funded, tax-advantaged insurance contracts are no mystery to the IRS. They are, however, complex for the average financial advisor or financial professional to implement without years of research and training.

Unfortunately, many advisors or accountants who "haven't done their research" can end up demonstrating a resistance to these contracts, based on uneducated or limited opinion versus fact, especially regarding the tax benefits and internal rate of return that can be achieved.

Over the last four decades, we have helped many highly successful people accumulate their money safely, earning predictable, tax-free rates of return averaging 7–10%. What that means is, when they retire, every $1 million dollars they have accumulated can generate $70,000 - $100,000 per year of tax-free income, without depleting the principal on their nest egg!

THE 5 REASONS WHY MARKET VOLATILITY IS HERE

TO STAY AND HOW IT WILL CONTINUE TO CREATE

CHAOS AND UNCERTAINTY FOR THOSE EXCLUSIVELY

USING TRADITIONAL INVESTMENTS

The predictable growth of real estate appreciation and stock market boom isn't coming back to the record levels we all saw in the 90s. Here is why:

#1 - Terrorism - The war on terror has not only changed the way we view America's role in the world, but 9/11 showed us clearly that a terror attack will create uncertainty in the markets, both nationally and internationally. No matter how well a company is being led and how much profit is being made, terrorism floods FEAR into the marketplace and can cause consumer confidence to deflate or even burst. Terrorism is a threat that isn't going away anytime soon.

#2 - The Global Economy - Economic boundaries are no longer tied to national borders. The financial health of other nations is now a viable factor in the resilience of the U.S. stock market. Additionally, the Internet has transformed the way companies do business, both at home and abroad. From companies moving manufacturing to other countries, to outsourcing jobs to lower-wage international workers, the global economy will continue to CREATE INSTABILITY in market growth.

#3 - National Healthcare - With the introduction of vast new and unpredictable healthcare laws, the markets will continue to be impacted by everything from slight to sweeping changes to this legislation. Even as these healthcare laws become increasingly irrelevant (with private companies and individuals bypassing the system with better alternatives), the industry’s legislative comings and goings will impact the economy.

#4 - Massive National Debt - While experts like David Walker, former US General Comptroller, have been clamoring for years about this time bomb, the federal government is just starting to discuss potential solutions for our nation’s out-of control blank check. The ramifications of a plan to pay for this debt, no matter what the solution is, will be very, very difficult for the markets to swallow without major upheaval.

#5 - Higher Taxes - As taxes increase, the market will react sharply negative. The more taxes go up, the less consumer spending will occur, and unemployment will rise as employers won’t be able to afford to hire or innovate (or will choose not to), which slows down the economy on a number of levels. Raising taxes is inevitable, when you consider the effects of massive national debt, the war on terror, national health care, and aging infrastructure.

I am optimistic that America will get through these challenges as it always has, but those Americans who are hoping that stability and security will be found through their 401(k) and IRAs are figuratively grasping at straws. It is evident that the next decade will be full of bumps and bruises for those who have not protected themselves from the brutal force of market volatility.

HOW MY MENTOR LOST EVERYTHING FINANCIALLY IN

1982 AND WHY YOU DON'T HAVE TO

REPEAT THE SAME TRAGEDY

My mentor's story is not unlike many who experienced huge financial losses in 2003 and 2008. In 1982, him and his wife, Sharee had a defining moment that changed their lives forever. They went from a six-figure income and owning their dream home, to financially losing our house and having to start over again to accumulate money.

This "defining moment" permanently changed the way they view finances, wealth, and retirement. They no longer take advice for fact, but look through the lens of their experience to see if that advice could have saved them financially. Some of the advice they hear is good—but not necessarily the best—because it isn't complete and won't save you in rough financial seas.

For almost 30 years now, Doug Andrew - my mentor- is not shy to admit that he haven't followed the crowd with his money, and his advice to you is to stop following the crowd too. It’s not always the most popular thing to do—follow a less-traveled path. The “crowd” laughed when he taught his readers, radio listeners, and live audiences about how to use max-funded insurance to protect themselves against stock market and real estate loss. But they gasped when they personally LOST MASSIVE AMOUNTS OF WEALTH in the 2008 market meltdown and real estate crash—and looked on as people following my advice didn’t lose money due to the market decline.

It seems that when we gain influence, the naysayers come out of the woodwork. They simply hadn't walked in my shoes and learned the hard lessons I had. Because they didn't understand, my critics ranted and doubted insurance as a repository for serious cash. But during the market crashes of the lost decade, these critics lost years of income, discipline, and savings.

When we worked closer with clients in the past, none of them lost their retirement nest eggs, in fact, they didn't lose any principal whatsoever due to market volatility.

They watched the markets go down and the economy become sluggish but slept well at night, despite the financial turmoil all around them. Then when the markets turned around, they enjoyed the benefits of market growth and great rates of return. These strategies helped many people safely double their money tax-free during 2000-2010.

MARKET VOLATILITY IS DRIVING AMERICANS TO

CHALLENGE CONVENTIONAL ADVICE

AND THEY ARE FINDING INSURANCE

A SAVVY, CONSERVATIVE SOLUTION

I want to fill you in on a little secret. The wealthy and privileged have known this for decades in their personal and professional lives:

Insurance stuffed with cash to the maximum limit allowed by the IRS has incredible benefits. It protects portions of assets and portfolios from the storms and whims of stock market decline.

Take a guess where the major banks and Fortune 500 companies invest their tier-one assets (assets that they want absolutely safe and liquid). It’s invested in BOLI and COLI (Bank-Owned Life Insurance and Corporate-Owned Life Insurance). Yep, banks have been earning—on the most conservative choices—3 – 5% tax-free on billions of dollars of OPM (Other People’s Money). What’s more, they only pay 1% on the money people have in savings with them.

You can “bypass the middle-man” with your serious cash.

As Americans are discovering this secret of the affluent, more are transferring wealth from real estate and stock portfolios. It is finding a new home at incredible rates. The most flexible of these types of insurance is Indexed Universal Life which has seen staggering industry growth of 28% each year over the past 12 years according to Wink's Sales & Marketing Report and their internal analysis, because of its superior performance.

I'll use a little analogy from the children's story of The Three Little Pigs to explain. If you remember, the story details three little pigs being hunted by a wolf who blows the houses of straw and sticks down, but not the house of bricks. The straw house is like stock market values, which get blown away when the hurricanes of volatility rage. The house of sticks is like real estate, which is a little stronger and more predictable, but also shaky in economic turmoil. (There are ways to minimize real estate risk, but that is a topic for another day.)

A max-funded, indexed universal life insurance contract, when properly structured, is a house of bricks that can protect you from the storms of market volatility. It makes a great home for a portion of your serious retirement cash.

Here is why:

#1 - Indexing - Your money is linked to the market through indexing, so that when the stock market performs well, you participate in the market gains. At the same time, if the market loses, your money is protected with a guaranteed floor.

#2 - Upside Potential - Your cash value will receive an indexing credit, based on the market/index that you select. When that market grows during a segment, which is commonly 12 months, your cash value will be credited with interest. If the market gains 12%, you'll gain 12%. The upside potential is generally capped at rates from 12-16%.

#3 - Downside Protection - If the market you are tied to experience large losses, like 2003 and 2008, YOUR CASH VALUE WON'T DECREASE due to market performance. The downside risk is eliminated because of a guaranteed floor, and because your money is in your insurance policy and not in the market

#4 - Lock and Reset – Whether it’s from interest credited from an index or cash value due to excess premiums, any gains are locked in and protected against loss, even if the index you are tied to loses. Each and every year this resets, so gains are added to the principal and are never lost due to market performance.

#5 - Liquidity - Your policy’s CASH VALUE CAN BE ACCESSED TAX-FREE via a loan. If you were to lose your job and need temporary income, your money would be accessible.

In addition to protection from market volatility, have you ever seen an insurance policy that does the following?

1) Has cash value that equals or exceeds the premiums paid into it during the initial years

2) Has an internal rate of return averaging in excess of 7%, thereby doubling your money about every 10 years

3) Allows you to access your money at a 7–10% payout rate without depleting your principal

4) The insurance can get cheaper as you get older

A max-funded, tax-advantaged insurance contract that is structured correctly and funded properly can do all of the above, and a whole lot more. Many highly successful people use them as a working capital account for real estate portfolios or operating a business—thus they act as their own banker.

"The biggest thing to me is that not only does it work, but it is safe and secure. You pick a good life-insurance company - it may be one of the safest spots in the world where you can accumulate funds, especially with all these tax advantages."

-Paul Barton

Estate Planning Attorney

HOW TO BUILD AND FUND A MAX-FUNDED,

TAXADVANTAGED INSURANCE CONTRACT TO

PROTECT AGAINST MARKET VOLATILITY,

ACHIEVE TAX-DEFERRED GROWTH AND

TAX-FREE LOANS DURING RETIREMENT

When most people think about insurance, they think about it strictly as a "death benefit." When the insured dies, this death benefit covers immediate needs, such as income replacement, estate preservation, and mortgage/debt protection.

When regular insurance is purchased for only the death benefit, you'll want to insure yourself to receive the highest amount of death benefit for the least amount of premium. The objective with a max-funded, tax-advantaged insurance contract is to structure your policy to have the least amount of death benefit, with the maximum amount of cash in the policy as allowed by the IRS.

When you build a max-funded, tax-advantaged insurance contract you'll determine, with the assistance of a qualified financial professional, how much cash you can place into your contract. There is no limit to how much it can grow to tax-free— only how much you can pay into it. Through a unique process, your financial professional will then determine the minimum amount of insurance you'll need to be in full compliance with IRS tax codes. This insures that money inside the contract, once it is in force, qualifies for tax-free loans and can grow tax deferred.

I'd like to share an analogy that may help you better understand a max-funded tax-advantaged insurance contract, how it is created, and how it is funded.

This type of insurance policy can be compared to owning an apartment building or running your own business.

If you were to own your own five-story apartment building, the goal would be to rent out all five floors in order to maximize profit and minimize expenses. If only the first floor were rented out and the remaining floors were left vacant, costs would remain extremely high and eat away your profits.

A max-funded insurance policy is similar. To maximize your returns and minimize your expenses, you want to fill up your contract with maximum planned premiums (this is like renting out all the available space). This can be accomplished in as few as five years to be compliant with IRS guidelines.

When creating and funding your insurance contract, there are four distinct, yet equally important phases:

1. Design and Approval

2. Acquisition

3. Maximum Funding

4. Profits and Distribution

Phase I - Design and Approval - Based on your financial and retirement goals, your financial professional will guide you in determining the size of your max-funded, tax advantaged insurance contract. THESE CONTRACTS CAN BE STRUCTURED TO HOLD THOUSANDS OR EVEN MILLIONS OF DOLLARS. They can be filled using only monthly or periodic deposits or they can accommodate large lump sum deposits. They can also be funded using a combination of both. Based on your financial objectives and assets available, your financial professional can design your contract to comply with IRS guidelines to allow for tax-deferred growth and tax-free loan access. It is important to remember that Phase I is the planning and approval phase, and the realization of tax-deferred growth and tax-free loans is achieved through Phases II, III, and IV.

Your plan then gets submitted to pre-selected insurance companies for approval and underwriting. While in underwriting, the insurance company will analyze:

1: The size of the insurance policy

2: The need for insurance

3: Your insurability

4: A variety of other factors.

(It may surprise you to know that people with previous medical conditions or people who may be older can often get superior approval ratings and excellent rates with some insurance companies).

Warning: Using a financial professional who is in-experienced in max-funded, tax-advantaged insurance contracts may have dire consequences for your future. Once an apartment building is built, changes are difficult to make regarding structure and floor plans. An insurance contract may be difficult to change as well, without incurring significant expense, especially if it was structured incorrectly from the beginning. The process of proper and effective max-funded design is significant and

necessary in order to maximize long-term profits, minimize risks and keep it flexible.

It is extremely rare when clients bring insurance policies that were structured for max-funding from other financial professionals that are structured optimally.

When building an apartment building as a business investment, you would use an

expert who has vast experience. To go to a general contractor with very limited experience, even though they may have the correct licensure, may have irreversible consequences. Just as a new building needs to be approved for building codes and funding, this type of insurance contract needs to be approved by the insurance company that you have selected with the help of a financial professional. When constructing an apartment building, it takes time to draw up plans, get approval, acquire financing, and build. Getting an insurance policy underwritten and approved takes time, as well. The process of getting an insurance policy approved can take anywhere from a few weeks to several months.

Be aware that not all insurance companies have the products that perform well when structured this way. To be specific, out of the massive insurance industry in the United States, only a select few companies have the ratings and the products that have passed our high standard of scrutiny—fewer than a dozen out of more than 2,000 companies.

Phase II - Acquisition - Once Phase I is complete and your insurance contract has been designed and approved, the next stage begins when you put it in force. This simply means that you make your first premium payment into your policy. YOUR MONEY IS NEVER DEPOSITED WITH US. It goes directly from your accounts to the accounts of the insurance company you select for your policy.

Once the money is received by the insurance company, your death benefit is in place in order to better protect your estate and assets. If an unforeseen tragedy were to occur your deposit(s) would blossom into a much larger benefit for your family and loved ones or your estate.

At the end of the acquisition phase (Phase II), your max-funded insurance contract is usually about one-fifth max-funded. If you only have one fifth of your apartment building rented out will the business of owning an apartment building be profitable? Of course not. If only the first floor was rented out, and the remaining floors were left vacant, costs would remain extremely high and would eat away your profits.

Designing and funding your insurance contract he first year is similar to the apartment building. It isn't profitable... yet. You'll need to max-fund the contract over the next four years or more. (It's called max-funded for a reason.)

New businesses are rarely profitable in the first year. It takes time to build a business, establish revenue, and grow consistently. Just the same, getting the most out of your max-funded, tax advantaged policy is at least a five-year process.

Consider the entire first year you own your policy to be Phase II. During this year, it’s best to fill up your contract with all the premium payments you planned to make. Near the end of your first year, also called the anniversary date, you'll receive an annual statement from the insurance company in the mail that details the amount of premium you've paid, cash value that has accumulated, and costs that have been charged during this year. You'll also want to meet with your financial professional for an annual review.

Every insurance contract is different, but generally the minimum amount of time it takes to maximum fund an insurance policy is five years, according to IRS guidelines (TAMRA). In other words, the IRS doesn't let you put the entire amount of planned cash into the policy in one year—they make you spread it over a period of years (often five)—otherwise when you go to access your money, it won’t be totally tax-free.

Phase III - Maximum Funding –

During the next phase, you will fill the policy with all the premiums that you have planned. This phase is generally years 2 - 5 but can take longer, depending on the plan you’ve created and how you actually fund the plan. We recommend that you meet with your financial professional annually to make sure you're on track, support you in staying accountable, and make adjustments as necessary.

During years 2-5, optimally you’ll continue to fill up your policy with all the planned premiums. During this phase costs generally go down substantially and you'll see your cash value get indexed and earn interest as the market grows. You'll also see your cash value not lose principal, even if the economy and stock market take a dive. Your financial professional can show you that as the years progress, the cost of the insurance can go down as you get older. This is because the amount of insurance at risk to the insurance company is reduced as it is replaced with your money and the interest earnings on that money. Remember for this contract to qualify as tax-free, the IRS requires a certain amount of insurance. The goal, then, is to have a small portion of the interest you’re earning pay for that insurance. This way, you’re essentially getting a net tax-free, attractive rate of return.

Filling the policy up to maximum levels during years 2-5 is like renting out the additional four floors in the apartment building that you own. Once your building is completely leased out, it is optimized for profits.

As the cash value begins to accumulate in your policy, THESE FUNDS MAY BE ACCESSED AT ANY TIME through a phone call to the insurance company. They will promptly put a check in the mail or do an electronic transfer. If you choose to borrow from your policy in the first five years, keep in mind that policies perform best when they are maximum-funded. The best time to borrow from your policy is after it is funded to the maximum amount allowed.

Phase IV - Profits and Distribution -

With your tax advantaged insurance contract maximum funded, you can work with your financial professional to decide when you want to take distributions, how often, and how much you want to borrow from your cash value on a tax-favored basis.

Your policy will continue to grow through the miracle of compound interest. Based on the index you are linked to, your contract will be credited with interest earned.

Policies that are max-funded can become very inexpensive in the Profits and Distribution Phase. They become very inexpensive due to the large amounts of cash you have in your policy. Let's say you've had your policy in force for 10 years, your policy has a death benefit of $1,000,000, and it has accumulated a cash value of $800,000. You're only going to pay costs to cover the remaining $200,000 of insurance that is at risk to the insurance company—the remainder is now your own money. If the insured were to pass away, the beneficiary would receive a total amount of $1,000,000. This is by far the most superior way to accomplish what the “buy term and invest the difference” proponents say, because you’re actually becoming self insured, but this way it’s totally tax free, and it's faster and performs much better.

Again, the best way to access your money is through tax-free loans. As long as your policy remains in force, no tax will be owed on these loans. If, however, you surrender your policy and cancel it, you may create a taxable event. That would not be the smartest exit strategy, but nonetheless, any cash you put directly into the policy (basis), would remain tax-free, as it has already been taxed.

THE TOP 7 REASONS WHY

EVERYONE ISN'T DOING THIS

#1 - Lack of Education – Many people and even advisors (including insurance agents) simply won't take the time to get educated on this approach. Probably half the people who've received this letter haven't made it to this page, so if you're this far, congratulations. An unwillingness to dig deep and get educated is at the root of financial misery. Most people spend more time planning a summer vacation than they do their entire financial future. Thus, we only work with people who will be responsible for their own future and will invest time in educating themselves.

A disturbing trend I also see is that many Americans never look past their employer's retirement plan. In many scenarios, they've only been presented with four different pie charts that represent different methods of allocation, and have been asked to choose one of them.

There is no substitute for learning about max-funded, tax-advantaged insurance contracts. To circumvent the learning curve, some people talk to a brother-in-law, friend, or financial advisor whom they trust—one who is likely uneducated about this specific and complex insurance strategy. This is like asking a dermatologist to perform your heart surgery. It’s imperative that you go to the experts. FINANCIAL ADVISOR TEST To determine if your financial advisor is equipped to help you understand and implement these strategies, ask the following questions.

Can you explain the tax citations DEFRA, TEFRA, and TAMRA from memory—off the cuff? If these tax citations aren't common language for your advisor, look for an expert. Your financial professional should know these rules backwards and forwards.

How many max-funded, tax-advantaged contracts have you put in force for clients (or do you personally own)? If this number isn't substantial, it's not worth the risk trusting their opinion to these matters.

Do you know how to access money or borrow out of an insurance contract via tax-free loans? If not, don't ask for his or her advice. We have independent tax professionals we can refer you to who can give you their educated opinions on these matters—who have completed advanced Continuing Professional Education (usually taught by me).

For many years, I ran the number one firm in the United States who knows how to structure max-funded, tax-advantaged insurance contracts in the most optimal way. The people I work with are constantly researching the newest and best products in the insurance industry, and very few meet our level of scrutiny for max funding. Advisors I work with are unwilling to take on a client who won't take the responsibility to get educated ... period.

#2 - These Policies Take Experts to Implement - Just like a general practitioner physician doesn't do brain surgery, most insurance agents don't do enough max funded policies to make them an expert. Max-funded tax-advantaged insurance contracts have a lot of moving parts, and to master the art and science of structuring these policies correctly, in-depth study and education is needed, just like a physician with a specialty.

Because I personally work with experts in max-funded, tax-advantaged insurance contracts, you can be confident the absolute best minds in the business are working on your retirement. Should it be any other way?

#3 - Insurance Is an Un-fun Word - Let's face it, nobody wants to think about insurance, let alone buy it. On your list of things to do today, I'm pretty sure you didn't wake up and say, "Honey, I'm getting this urge to learn about insurance." It was probably more like, "What are the top three things I DON'T WANT to do today?" and learning about insurance was right at the top of that list. And here I am telling you how incredible insurance can be.

#4 - These Insurance Policies Are Mislabeled as Expensive - Traditional financial planners often make the naïve claim that this type of insurance is expensive, and yet they know little about how we structure them to outperform stocks, bonds, municipal bonds, mutual funds—especially when taking into consideration the tax ramifications of various investment alternatives. These types of insurance policies can have unnecessary costs if they are not structured properly and are not funded according to design.

These contracts are not short-term, but long-term cash accumulation vehicles—meaning five years or more, designed for superior cash accumulation. When properly structured and funded properly over a period of time, costs can actually be very inexpensive, specially the cost of insurance relative to the gross rate of return. By structured correctly, I mean as little insurance as possible is purchased to still fall within IRS guidelines.

Most traditional advisors make their money as a percentage of the total assets they manage. Insurance professionals with these types of policies receive no management fees from the insurance company. Comparatively, traditional financial advisors may make substantially much more money on assets under management than an insurance professional who has assisted a client in putting a policy in force.

#5 - People Generally Think Short-Term - By nature, human beings aren't long term thinkers. The "instant gratification world” in which we all live, in part due to the Internet and technology, puts the focus on results next week, not years from now. If you are looking for "get rich quick" strategies, insurance is not the place to look. It is a long-term strategy (five years or longer) for individuals who are financially disciplined. As I emphasize in all of my best-selling educational books, you shouldn’t buy investments based on which ones grow to the most; but rather you should choose the investments that generate the most net spendable income at the time in life you will need the money the most. I can show why a max-funded insurance contract will far outperform most traditional IRAs and 401(k)s invested in the market. A maxfunded, tax-advantaged insurance contract earning 8 percent can outperform an IRA or 401(k)—even if an IRA or 401(k) earned as high as 12 – 16%—because of the tax-favored treatment.

#6 - This Isn't for Everyone - I'm not here to convince you to invest in something you don't want or need. In fact, it may surprise you to know that this strategy isn't for everyone. Some clients use strategies outside of max-funded insurance because they have different needs. Some want predictable income or guaranteed cash flow for five or 10 years, or even a lifetime. Thus, other products may be better suited for their financial needs—those that can perform with a 6, 7 or 8% effective yield—although they are not tax-free like the max-funded, tax-advantaged insurance contract. Some clients use strategies outside of max-funded insurance due to health or age restrictions. However, you may be surprised to learn how many still qualify and use (MFTA) insurance even though they have pre-existing health conditions.

#7 - You Must Have Assets - This strategy is perfect for those who have accumulated substantial nest eggs for retirement who are looking for safer and more secure financial options that provide liquidity and tax-advantaged, predictable rates of return. If you don't have substantial cash accumulated, we don’t recommend that you own an MFTA insurance contract unless you can put aside at least $500 a month into a policy for at least 5 years.

If you're not at this level of discretionary savings, a max-funded, tax-advantaged insurance contract isn't for you yet.

ARE YOU DESTINED TO REPEAT THE

MISTAKES OF THE PAST OR MOVE FORWARD

WITH CONFIDENCE AND SECURITY TOWARD

A BIGGER, BRIGHTER FUTURE?

Why do investors have such short-term memories? It seems that human nature teaches us that people try to forget pain as soon as possible, but they only take minimal action to prevent that pain from reoccurring.

Many investors who follow the crowd seem to have forgotten that 2003 and 2008 ever happened, even though their account balances are startling reminders of the losses they suffered due to the global economy, terrorism, and massive national debt. It's almost as if they've put their blinders on, determined to move forward (even if it means walking off a fiscal cliff). Savvy and smart investors, on the other hand, have searched and found

conservative, safe, and proven financial strategies that are homes made of brick, instead of straw or sticks. A house of brick can withstand these storms and defiantly say, "Let the storms rage." Max-funded, tax-advantaged contracts are proven to be solid, secure, and predictable. They've also shown promising rates of return, even during periods of volatility.

I'd encourage you to join the community of those who have taken the blinders off and see if a max-funded, tax-advantaged insurance contract is right for you. If this isn't the right solution for you, we may have other financial solutions that will move you toward greater financial security and strength.

I'd invite you to take the next step below:

Simply request to meet with an IUL Specialist or financial professional to see if a MFTA contract would be right for your specific situation. An IUL Specialist will encourage your education in regards to these strategies and will meet with you on several occasions before any financial decisions are made. This will allow you to weigh your options with the help of our expertise—and without sales hype or pressure.

1 Life insurance policies are not investments and should not be purchased as an investment vehicle or instrument.

2 Policy loans and withdrawals will reduce available cash values and death benefits and may cause the policy to lapse, or affect guarantees against lapse. Additional premium payments may be required to keep the policy in force. In the event of a lapse, outstanding policy loans in excess of unrecovered cost basis will be subject to ordinary income tax. Tax laws are subject to change and you should consult a tax professional.

Policy loans are not usually subject to income tax, unless the policy is classified as a modified endowment contract (MEC) under IRC Section 7702A. However, withdrawals or partial surrenders from a non-MEC policy are subject to income tax to the extent that the amount distributed exceeds the owner's cost basis in the policy.

3 Hypothetical based on index with 140% participation, 11.2% cap, and 0% floor

Dora Wysocki

Tax FREE Retirement Specialist

© DW Financial Group - All Rights Reserved.